Accounting principles when dealing with debit order collections

The concept of a debit order service provider collecting funds into another bank account and then releasing/paying out the funds to your organisation’s account might be quite a strange concept to grasp for many bookkeepers and accountants in the industry.

Understanding how to correctly record these transactions in the books can be a tedious task and sometimes fails miserably especially if you’re unsure how your debit order service provider works.

What makes it even more complicated is the fact that most service providers do not provide their clients with proper tax invoices and ways to reconcile what the actual fees are that they paying for their debit order collections.

Direct Debit, on the other hand, is a lot more transparent when it comes to monthly reporting and invoicing.

We provide our clients with a repayment schedule stating exactly how much is collected, what the repayment terms are, how much will be paid out and when the funds will be paid over to the organisation’s bank account, making the process a lot more clear and efficient.

We also send out detailed monthly invoices stating the amount of transactions that were processed along with the fee per transaction whilst adhering to the VAT rules set out by SARS as to the components of a standard tax invoice.

As we have received numerous queries regarding the concept of collecting funds into an internal account and releasing it, on repayment terms to the organisation’s bank account, we have decided to explain how this works in relation to your general ledger and basic accounting principles.

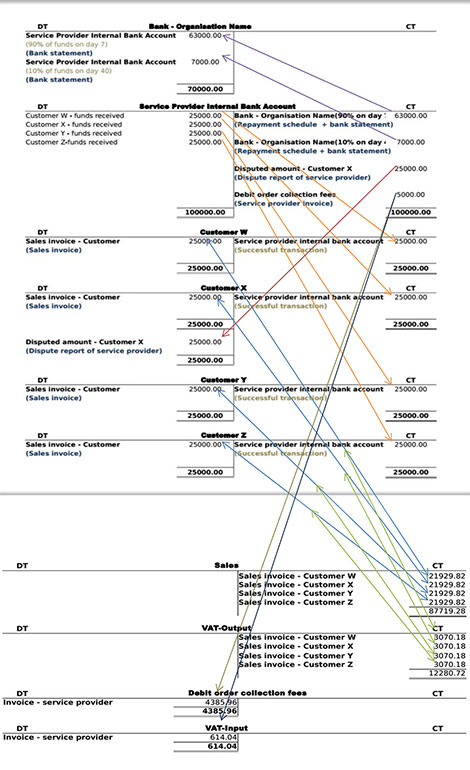

Below are some examples on how you can bring in the internal bank account where the funds are originally collected to as well as how the funds are paid out to the company’s actual bank account.

These examples also include normal sales, VAT, expenses and customer accounts to provide a comprehensive overview on which accounts are involved when recording transactions.

1. The general ledger accounts are as follows; followed by a journal based example:

2. Journals relating to the general ledgers above:

|

Date |

Description |

Debit |

Credit |

|

R |

R |

||

|

01/01/2014 |

Customer W |

25,000 |

|

| Sales |

21,929.82 |

||

| VAT-Output |

3,070.18 |

||

|

01/01/2014 |

Customer X |

25,000 |

|

| Sales |

21,929.82 |

||

| VAT-Output |

3,070.18 |

||

|

01/01/2014 |

Customer Y |

25,000 |

|

| Sales |

21,929.82 |

||

| VAT-Output |

3,070.18 |

||

|

01/01/2014 |

Customer Z |

25,000 |

|

| Sales |

21,929.82 |

||

| VAT-Output |

3,070.18 |

||

|

01/01/2014 |

Service provider internal bank account (funds collected) |

25,000 |

|

| Customer W |

25,000 |

||

|

01/01/2014 |

Service provider internal bank account (funds collected) |

25,000 |

|

| Customer X |

25,000 |

||

|

04/01/2014 |

Customer X |

25000 |

|

| Service provider internal account – Dispute |

25,000 |

||

|

01/01/2014 |

Service provider internal bank account (funds collected) |

25000 |

|

| Customer Y |

25,000 |

||

|

01/01/2014 |

Service provider internal bank account (funds collected) |

25,000 |

|

| Customer Z |

25,000 |

||

|

01/01/2014 |

Debit order collection fees |

4,385.96 |

|

| VAT-Input |

614.04 |

||

| Service provider internal bank account OR company bank account for external billing |

5,000 |

||

|

07/01/2014 |

Bank – Company |

63,000 |

|

| Service provider internal bank account |

63,000 |

||

|

10/02/2014 |

Bank – Company |

7,000 |

|

| Service provider internal bank account |

7,000 |

Direct Debit supports all clients through every aspect of the payment collection process including the correct recording of debit order transactions in the books, while providing assistance and transparency every step of the way.

Contact us for further information